I have been eagerly waiting for this report. After a long and excruciating period of lobbying by small business interests, big businesses finally have to ‘fess up to their payment practices. The length of time that big organisations take to pay their SME suppliers has been a sore point with small business owners and managers for a very long time

This first report from the Payment Times Reports Register appeared on 30 November 2021. The relatively new legislation compels all Australian companies with a turnover greater than$100m to report how long it takes them to pay their small business suppliers. The first compulsory reporting period closed on 30 June 2021.

Now we can see the facts.

6413 large businesses submitted a report. I do not know if there were any who missed the deadline and didn’t lodge their numbers.

Each company had to state it’s Shortest, Standard (Default), and Longest Payment Terms to their small suppliers. Then they have to declare what percentage of invoices were paid in the following time brackets:

- Less than 20 days

- 21 – 30 days

- 31 – 60 days

- 61 – 90 days

- 91 – 120 days

- More than 120 days.

(There’s more they have to report on, but these are the important parts).

For example, one company shows the following:

| Default Payment Terms | Shortest Payment Terms | Longest Payment Terms | % of invoices paid in | |||||

| <20 days | 21 – 30 days | 31 – 60 days | 61 – 90 days | 91– 120 days | >120 days | |||

| 45 days | 30 days | 75 days | 46.9% | 5% | 24.1% | 19.8% | 2.4% | 2% |

How many invoices are paid late?

Unfortunately, we can’t see how many invoices were paid after their actual due date, but let us make the very reasonable assumption that anything over 30 days is “late”. Even if the trading terms are longer than 30 days, they shouldn’t be.

Using this assumption, just over one third of invoices are still being paid late.

Payment Terms – the facts

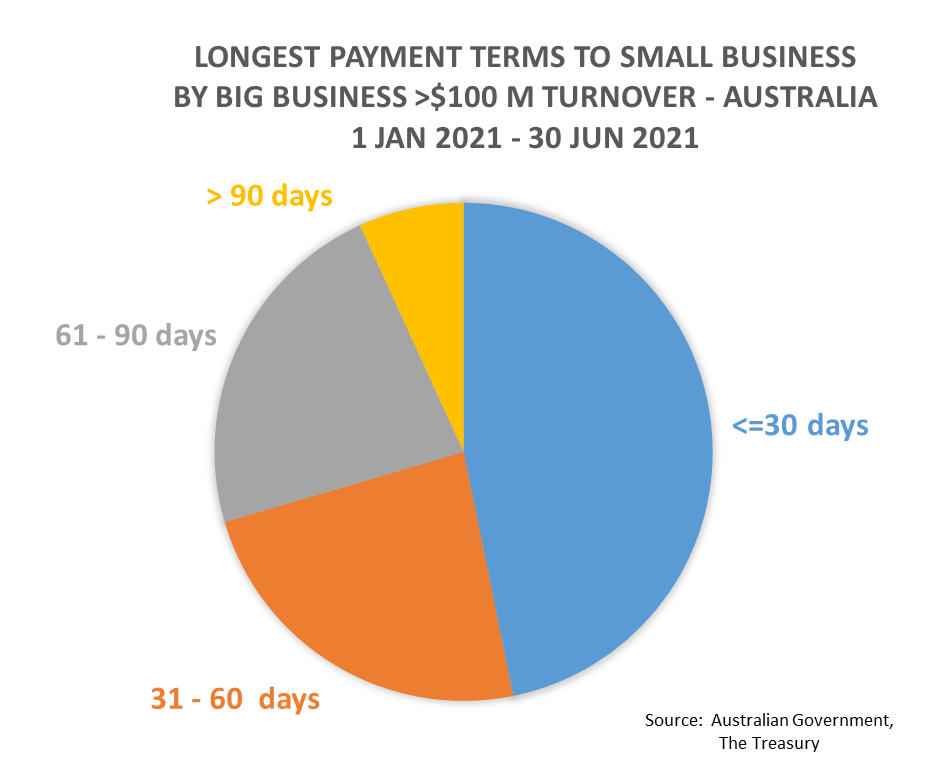

The report shows that we still have a long way to go before we reach the target of 30 day payment terms for all small businesses.

The graph below shows the breakdown of payment times (longest payment time reported). Unfortunately, just over half of Australia’s big companies still have payment terms greater than 30 days:

Over half Australia’s big companies still have Payment Terms of more than 30 days for their small suppliers.

Incredibly, there are firms that still have payment terms of 120 days and over, and 11 of these were over one year! (One reported 1095 days, but I’m going to treat that as a typing error).

How you can use the Report

Now that we finally have this data at our fingertips, we can all use it as valuable business intelligence.

Let’s say that you are about to sign a contract with Company ABC. You have never dealt with them before, so you have no idea about how good they are at paying their suppliers. Previously, you would have to try and find another business that was selling to them, and hope they would help you out by giving their opinion. There were also commercial organisations that could give you some information, but usually only if another business owner had already reported them as a bad payer.

Now, the information is there for all to see. You can go to the report spreadsheet on the internet, look up the name of your prospective client, and find their track record.

The company I used in the example above seems to be doing quite well. It is paying close to half (46.9 per cent) its invoices in less than 20 days – that’s less than their own shortest trading terms of 30 days!

Here is another example – this one may need to sharpen up it’s Accounts Payable section. It’s longest payment terms are 15 days, but only about half (56.3 per cent) of its invoices are paid in that time period or slightly longer.

With this information, you can make a decision about whether you want to do business with them or not. If their longest payment terms are 120 days or more, you may consider that the contract isn’t worth constantly waiting all that time for your money. At the very least, you will be forewarned that a negotiation process is ahead of you when it comes time to sign a contract.

This first Payment Times Report marks an important milestone in the long, drawn-out saga of getting big companies to pay their small suppliers in a timely manner. I will be watching for the next report to see if there is any improvement. Stay tuned for the next instalment…