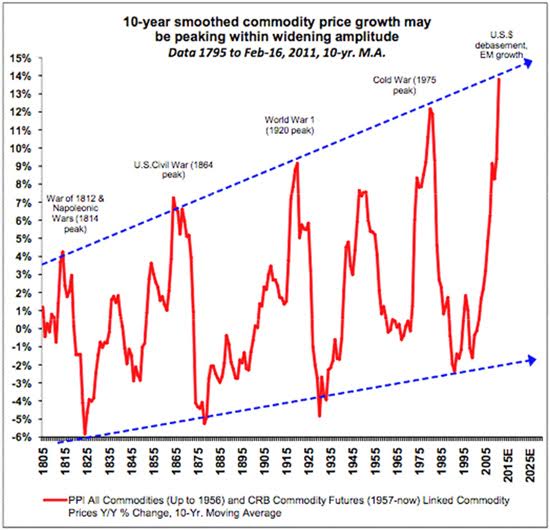

A historical trend – the commodities supercycle – suggests the fall in commodities prices that started with the GFC in 2008 could continue for up to another two decades

Sponsored Article

With commodity prices falling substantially, and for a significant period of time, it’s human to assume that they must inevitably reverse in the near future. The reality is that this is something of a fallacy, as historically commodities prices have moved in gargantuan cycles, with price trends continuing, in some cases, for decades.

Whilst many intelligent and well-reasoned experts dispute the existence of a commodities Supercycle, often based on the assumption of finite resources and changing technological and systemic conditions; it is hard to argue that prices have behaved in a somewhat consistent and cyclical fashion.

Assuming the cycle does exist, it often measures (very) roughly thirty years peak-to-peak, and with the Bloomberg commodities index peaking in 2008, the first implication is that the next peak will not occur for another couple of decades.

The second implication is that the trough of the current cycle may not yet be realised.

This may be especially true when you consider that growth in demand for commodities is coming largely from emerging markets; whose growth rates are expected to remain subdued in 2015 and 2016 according to the International Monetary Fund. Indeed, emerging market GDP growth is set to fall to 3.6% on average this year, their lowest level since the 2008 financial crisis according to Oxford Economics.

This has come at a time when supply of most commodities is at or near all-time highs, due to the legacy of production investment from the recent peak in the cycle.

In response, Goldman Sachs has removed their overweight rating on the energy sector (which they famously placed early this year), as well as lowering their 2016 average price target to $45 a barrel. They have additionally stated that the risks of a total price collapse to $20 a barrel are growing.

Hedge fund managers are smelling blood, with John Burbank declaring in the Financial Times that he is not pulling out of his bearish bets, most notably on commodities trader Glencore. Mr Burbank currently has two hedge funds in the top 15 best performers, year to date, according to the industry league table compiled by HSBC, based on bets against commodities and emerging markets.

All of this is bad news for Australian commodities producers, with only part of the price falls offset by the falling AUD. If the commodities rout continues, some of our largest and most successful companies will be under some serious pressure, and the chance of an Australian recession will greatly increase.

Brought to you by Sam Green, Advisor at Options Trading Educator – TradersCircle