In July 2014 I wrote the below article, indicating that an early move on interest rates by the US Federal Reserve may cause a market correction, just as had occurred in 1937.

With September 2015 coming up with a possibility of an interest rate increase, the Dow Index has corrected by 19.5% down from the recent high. The message from the market to Janet Yellen is clear: ‘Please tell us that interest rates will not increase this year and that the Fed may look at increasing rates next year.’ This behaviour is the same as that experienced during the GFC. Unless the market gets what it wants, ie lower rates, QE1, QE2, QE3, the selling is likely to continue.

An early move on interest rates by the US Federal Reserve may cause a market correction, just as occurred in 1937.

From July 2014:

The US Federal Reserve has maintained a commitment to a zero interest policy (ZIRP) for the foreseeable future. Even with the unemployment rate falling to 6.1%, the language from the Fed has not changed. Any change of language will mark a shift in a change of direction in the share market.

ZIRP has had its desired effects. It is possible, as an investor, to fund share market investments at a margin of 0.6% above the Reserve Bank rate. A share market broker advertises on its website that funding is available at 0.7% (0.1% plus 0.6%) for US shares and 3.10% (2.5% plus 0.6%) for Australian shares. The S&P 500 Dividend yield is 1.89%, with the earnings yield at 5.1%. It really is a no-brainer – the cost of borrowing is less than the yield you receive from the shares, and much less than the earnings of the companies.

But there are fears that the US Fed will change direction in interest rates. But will an increase in interest rates be appropriate – is the underlying economy really recovering? And even if the economy is recovering, has ZIRP blown too many bubbles into the system so that increasing interest rates will force an unwind in the current investment strategies.

The current situation is often compared to 1937 when the US was recovering from the depth of the Great Depression. Back in 1937, the 3 month Treasury rate was at a similar rate as today (0.10% to 0.20%). The Government signalled to the market that it wanted to increase interest rates with the 3 month Treasury bill yield rising from 0.15% in March 1937 to 0.38%.

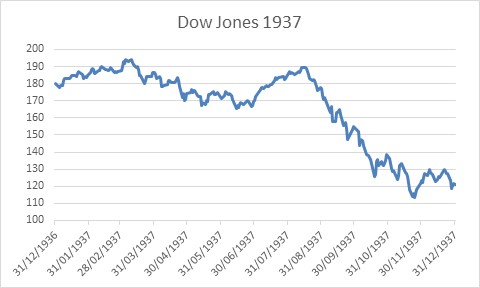

March 1937 marked the top of the DOW at an index level of 194, as indicated in the DOW Jones graph below.

In April 1937 rates increased further to 0.56%. The DOW trended down to 169 by the end of June 1937, a 13% correction from the March high.

The Government reversed the direction of interest rates with the interest rates being lowered to their previous lows. The market reacted by returning to the previous high of 190 by August 1937. The economy may have been damaged by the early move on interest rates, but nevertheless the market began a 50% correction to 98.25 by March 1938.

Will 1937 be repeated? There are plenty of differing views politically about what direction future interest rates should take. Certainly many politicians would lift interest rates today if they were able. A more hawkish Federal Reserve Board would probably be appointed.

Primarily, investors need to listen out for any change in language coming from the Federal Reserve as a precursor to a change in direction of the market.

Mike Cornips, Managing Director, Options Trading Educator, TradersCircle