As has been typical of past Labor Governments Jim has delivered a not so “Charming” budget for small business. On a relevance and word count basis the Treasurer could only manage mention ‘small business’ the once.

Whilst there were some indirect measures announced the Treasurer has missed the mark with a lack of any real direct support for small business.

Indirect support measures

1. Workforce skills shortage:

Small businesses are faced with workforce shortages. To alleviate this the Treasurer announced childcare and other subsidies plus a boost for aged pensioners that may assist in enabling parents and pensioners to re-enter the workforce.

2. Green Energy:

Introduction of a grant will assist those small businesses looking at upgrading their energy efficiency.

3. Mental-health support and debt counselling:

Funds will be redirected from ASFBO towards mental health support and debt counselling for small business.

4. Increased compliance:

Funding for the ATO and Tax Practitioners Board to target compliance. Hardly a support measure for small business.

5. Fair Work:

Funding announced to assist small business with enterprise bargaining rules and to assist with the plan to legislate paid family domestic leave.

Public enemy number one – inflation

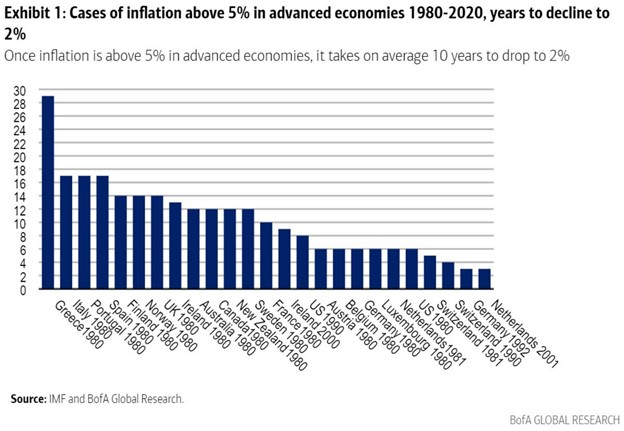

The Treasurer called inflation “public enemy number one” and rightly so, it is an insidious tax. The Budget had targeted cost of living measures providing affordable childcare and less expensive medicines but nothing on energy inflation. Much of the inflation, per Mr Chalmers and government, is from increasing energy costs linked to the war in Ukraine – which the history books suggest may go on for decades.

There is a plan to reduce energy costs with renewable energy, but the transition will take years, trillions of dollars for infrastructure and worst case, maybe decades to achieve 80 per cent or more renewables for household, industry and motor vehicles. So, is the promised return by the Treasurer to a three per cent inflation rate by 2024 possible or pie in the sky?

Inflation and, thus, high interest rates here to stay

If history is a guide and the Ukraine war runs for the rest of this decade we may be looking at inflation being high at a time when the world is in a recession. Persistent high inflation means persistent high interest rates. And for small business both of those are perilous.

Small business is bearing the brunt of inflation. First, energy costs are driving up costs which drive up prices which reduces demand. Then, for those businesses that borrowed on the bank of the RBA’s prediction on virtually nil interest rates to 2024 (good forecasting), they are getting hammered by expensive interest rates as are their clients which reduces demand. Finally, the available small-business workforce is shrinking as the Baby Boomers – all five million of them move from the workforce to retirement. Who is going to replace them?

Insolvencies are up

With the increased costs and borrowing pressures what will happen when small businesses and the dreams of their owners crater? So, what help is the government giving small business in the Budget?

A better way

The scourge of energy inflation saw inflation in Australia run over 10 per cent for almost a decade. The Treasurer and the Prime Minister said they are looking at regulating energy costs and suggest there is a better way which will help all Australia.

One possible idea is that the Government mandate an Australian cap for electricity inputs sourced in Australia such as LNG while still allowing producers to sell into an inflated energy market impacted by the war in Ukraine.

It does not seem fair for Australians to have to pay international prices for energy inputs from our country. If we can deliver cheap energy, and Australia has an abundance of it, then small- and medium-sized businesses will have a competitive advantage meaning more jobs, more manufacturing and a stronger GDP.

For me Treasurer Chalmer’s budget is a ‘miss’ for small business.