Businesses are always making changes, taking on new staff and purchasing equipment – bear in mind these actions affect insurance so review your cover regularly

Sponsored Article

Risk management strategy key to protecting livelihood.

It is no secret that running a commercial enterprise is hard work. Managing the day-to-day tasks is a full-time job in itself, let alone dealing with the unexpected. This is why it is vital to have an adequate risk-management strategy in place to ensure your livelihood is well protected.

We all know that insurance is essential, but sometimes it can be a complicated and confusing product to purchase. How do you know that everything is covered, and for the right amount? Next time you make a significant business decision you’d be wise to spend a moment considering if it has any impact on your insurance exposure.

If you take on new premises, hire employees or buy vehicles, tools or equipment, then you might need to review your policies.

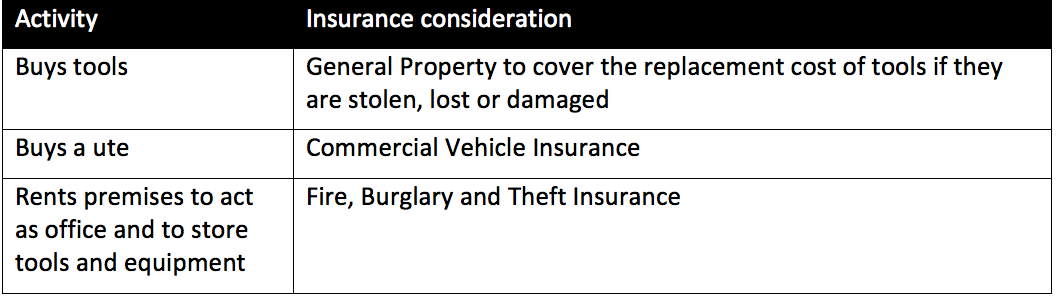

Consider the case of a plumber, who first starts operating their business from home. At first they may simply require a liability cover to protect against the costs of a claim made against them for property damage or personal injury caused by their business activities. As the year continues and the business grows, consider how the following activities may impact the plumber’s insurance requirements:

In the eyes of your insurer these changes can all impact the risk exposure of a business and requirement for additional cover. It’s therefore worth keeping in mind that one of the most important relationships a business owner can keep is with their insurer. A phone call to your insurance company whenever you make changes to your business can help ensure that your livelihood is adequately protected and you’re not risking underinsurance.

Brought to you by WFI Business Insurance