Last week we looked at the results of the 2013 MGI Australian Family and Private Business Survey (Read part 1)

Succession (or exit) will happen to you sooner or later, and it is important to take charge and manage the process rather than just let it happen to you. I have worked with many business owners who have successfully done this, and in so doing have devised excellent exit strategies. They have managed to substantially improve the value of their business, find a strategic buyer to preserve (and often improve) their legacy, and been able to fund their retirement.

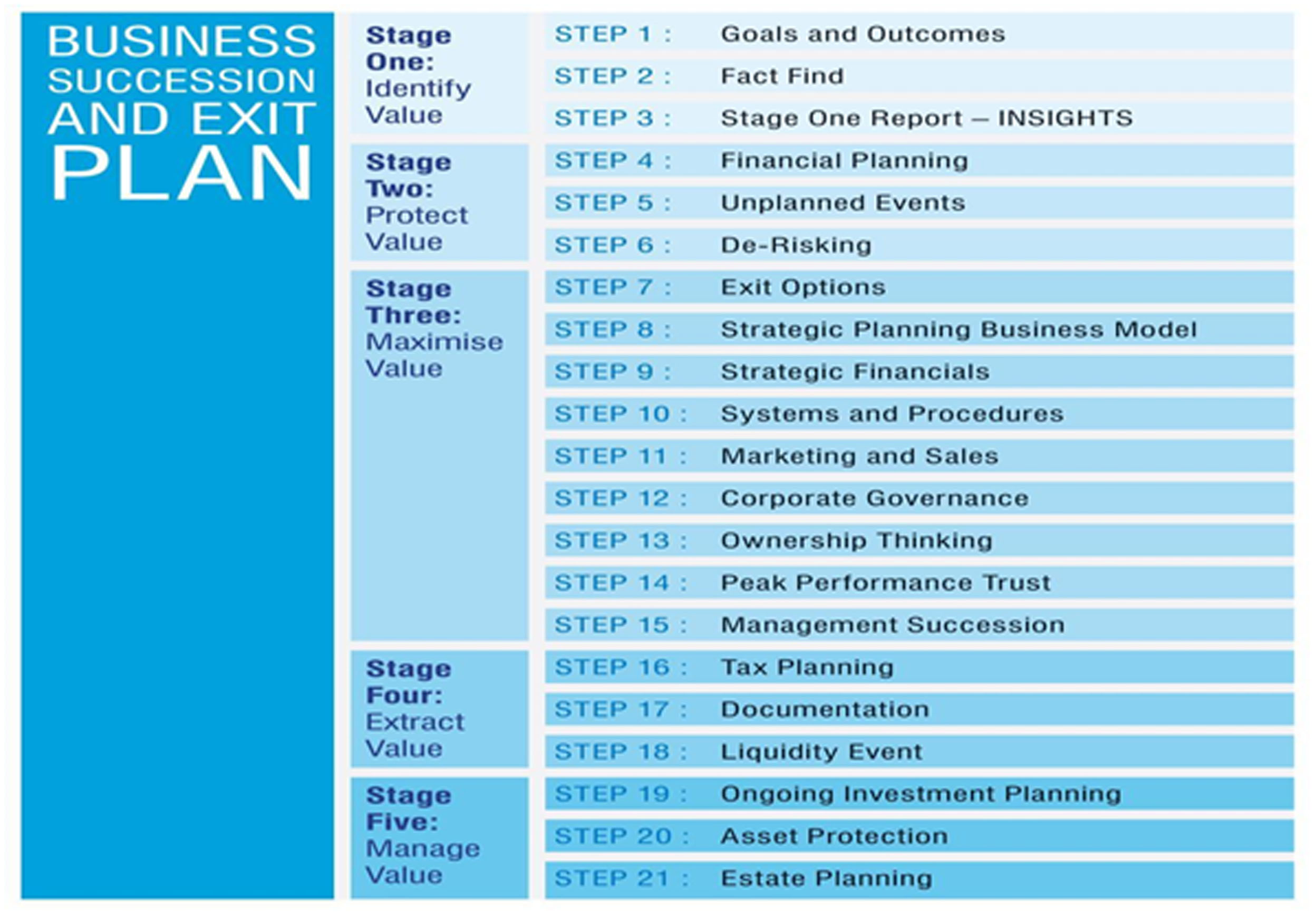

We employ a 21-step process with clients to create a business succession policy (often over three to five years) and this process has been specifically designed to achieve the best possible exit outcomes for the business owner.

The most important lesson of all is to ‘begin with the end in mind’ – design the business, implement your strategy, and recruit the right people with your exit in mind. The alternative is to be the passenger throughout the journey to the exit, unable to influence the direction and outcome, and not the driver!

The most important lesson of all is to ‘begin with the end in mind’ – design the business, implement your strategy, and recruit the right people with your exit in mind. The alternative is to be the passenger throughout the journey to the exit, unable to influence the direction and outcome, and not the driver!

Achieving a successful outcome is really focusing on two areas. The first, which we’ll look at now, is internal – the key things to focus on in the business to ensure it is valuable, attractive and saleable.

In my experience there are eight key areas:

- Size – Simply put, ‘size does matter’ – there is much research that supports the fact that businesses with a turnover of $5 million or more nearly always sell at higher multiples than their smaller counterparts. Whilst I am not in favour of growth for growths sake, designing your business to grow to at least this level of turnover will maximise value. This might include making acquisitions (of complementary businesses/opportunities), opening in other states or looking for baby-boomer business owners desperate to exit and retire. Interestingly, research shows the top two outcomes for a successful exit by baby boomers are not about the money – rather they want assurance the business will continue after the exit (legacy) and that you will look at their staff.

- Business model – Is your business boutique or scale and, even more importantly, is every aspect of your business – customer service, online presence, the people you employ, your pricing strategy, your office location and fit-out and your marketing materials – aligned with your model? I met a financial advisor just last week who told me he looked after high-net-wealth individual clients, was extremely good at what he did and as a result charged a premium. He then gave me a business card on very flimsy paper that looked as if it had been printed as cheaply as possible.

Businesses that need to make sales continually, every day, week and month are far less valuable than a business with long-term guaranteed and/or recurring income.

- Revenue – Recurring revenue is worth more. Do you have clients on long-term retainers, extended contracts, or some type of residual income trail? Businesses that need to make sales continually, every day, week and month are far less valuable than a business with long-term guaranteed and/or recurring income.

- Sales and marketing – Your business needs to be able to generate new business, leads, enquiry and ultimately sales without relying on either you or a key person’s skill and sales ability. All businesses need a sales and marketing machine that runs independently.

- Systems – Save Your Self Time, Effort & Money. Not only are systemised businesses far simpler to run, far less stressful and generally far less risky but they are also more valuable. The chance of them performing well is higher and the level of specialised skill to run them is reduced by systems. Lower risk is always more valuable.

- Employees – Do you have an employee incentive plan whereby employees are rewarded based on performance, either a profit-share-based plan or ideally an employee-share-ownership plan (ESOP)? This substantially reduces one of the key risks for buyers – that is, that your employees will exit when you do! It also provides a string incentive for performance to our people – their financial well-being (at least a part of it) is closely matched to yours as the owners. The better the business performs, the more profitable it is – they are better off. Getting employees to think and act like business owners can make a substantial difference.

- Corporate governance and compliance – Often ignored by business owners as either something large businesses need to worry about or simply too hard and far too boring, but this area (particularly when we look shortly at attracting the right type of buyers) can add considerable value and again reduces risk. Often we see deals fall over at due-diligence stage, when the buyer really investigates the substance behind the business. Those with poorly prepared accounts, badly documented processes and little or no governance structures often fail to meet this hurdle.

- Owner dependence – The business must be able to run independently of your involvement. You must be able to leave for two months on a holiday in Europe without contact with the office and the business maintains, continues and even improves its performance while you’re away. Some of the items above will help to reduce the dependence upon you (or your family).

NEXT WEEK: The external factors that will attract the right buyer for a business at the right price when the time to exit comes.

Craig West, CEO, Succession Plus