Business is all about figures, and the many variables throw up lots of numbers – focus on six key ones to boost your business

Sponsored Article

When you’re running a business, there’s a lot to keep in mind. If you keep track of these six key numbers, your business will thrive.

Sales revenue

The lifeblood of any business

You should be comparing each month how you have done versus last year, your budget, any revised sales forecast and how this compares to your break-even.

The more regularly you report sales revenue, the better. Adopt weekly and daily reporting where possible.

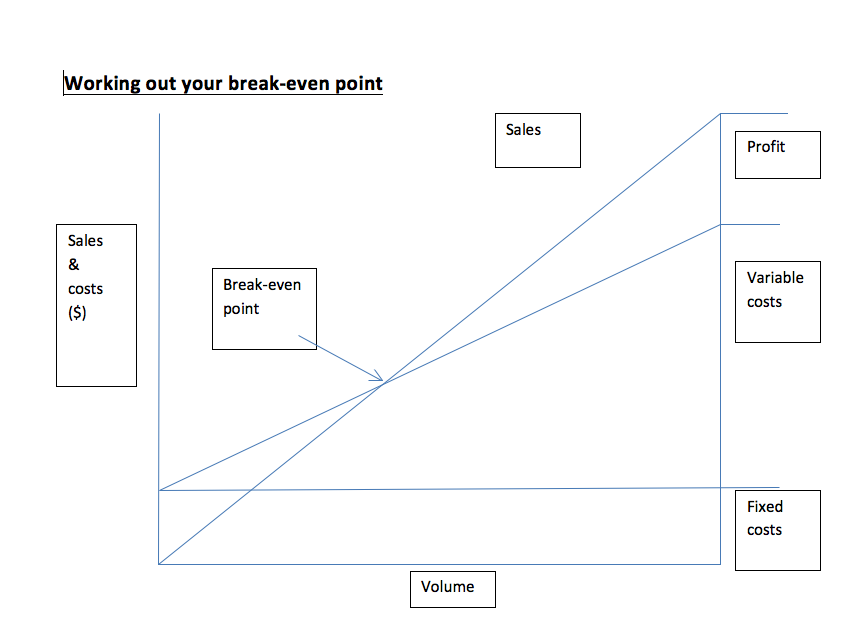

Break-even

The level of sales you need to achieve so that you are not losing money

Break-even is calculated by splitting your cost structure into fixed and variable costs. Fixed costs include anything that you can’t vary in the short term such as rent. Variable costs vary with sales. Typical examples are distribution costs, costs of product sold, labour costs related to production: in fact, all costs that vary as sales go up or down.

Getting your break-even point as low as possible will boost your business and give it more flexibility.

Gross margin percentage

The sales less the variable costs of producing these sales

The absolute level of money is important to monitor, but the percentage gross margin is key.

The absolute level of money is important to monitor, but the percentage gross margin is key.

The higher you can get this the better, as it shows the profit benefit for each additional unit of sale made.

For example: you have a business that generates 40% gross margin. For each additional $1000 of sales, you should expect an additional $400 of profit to flow directly through to your profit line, as other fixed costs shouldn’t vary very much in the short term. If the gross margin of your business is only 20%, obviously you have got to sell twice as much to get the same profit effect.

Fixed overhead levels

Monitoring the fixed overhead level is important, as are the ways to always be looking at how you can reduce these levels without harming the ability of your business to serve customers.

Net profits

Most businesses need to make a profit to survive, so comparisons to budget, forecast and history are all important, as well as interfirm comparisons, and comparing your profit to sales % and with the funds you have invested in the business.

The higher your profit %, the higher return you are making.

Rather than just taking your costs away from what you think sales will be to get a profit the business delivers, try turning this around. Decide, based on some research, what you think your profit % to sales and funds invested should be, and then consider what you need to do with either your variable cost or fixed overheads to deliver your target profit. You may be surprised to see what this simple change in thinking can deliver.

Cash headroom

The difference between your cash balances and the maximum borrowing limits you have set up.

There are a number of differences between the profit your business is making and the cash it’s generating, or not. Make sure you understand those differences and keep monitoring your cash position.

Most businesses go bust simply because they run out of cash, particularly growing businesses. The absolute level of cash or overdraft you have is critical, but the ‘headroom’ you have in your funding facilities is the key number to monitor.

Headroom calculation:

You have a maximum borrowing facility with the bank of: $1,000,000

Your current borrowing facility is: $600,000

This gives you headroom of: $400,000

Brought to you by Rupen Kotecha, MD & Regional Director, CFO Centre