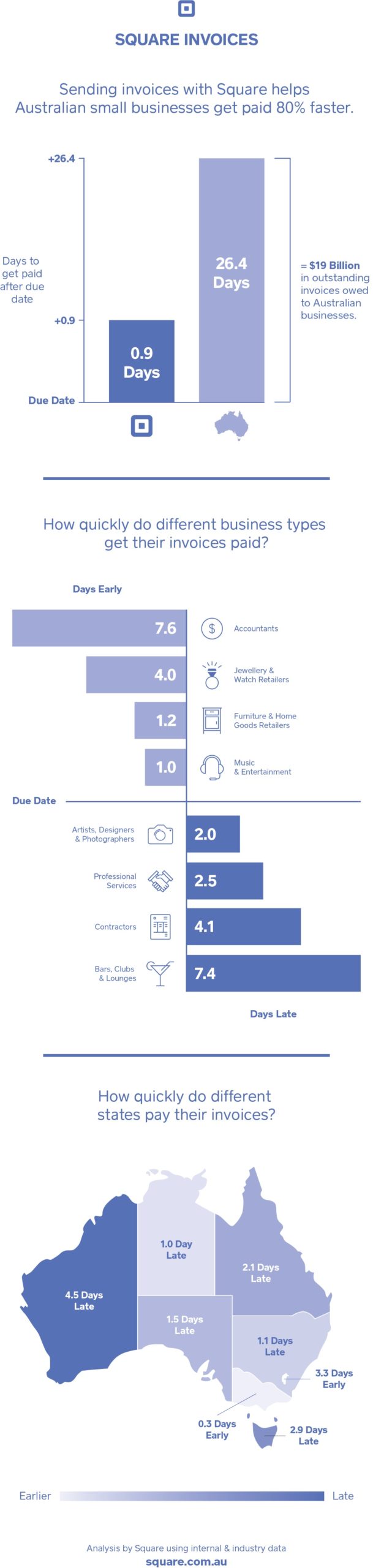

The billions of dollars caught up in delayed invoice payment in Australia pose an extra strain on businesses from both a financial and time-efficiency perspective.

Australians are famous for their laid-back nature and that is translates into how we’re doing business – typically paying invoices almost a month late. As a nation, Australia ranked bottom of the table behind other nations including the US, Canada, Mexico, Ireland and Denmark* when it comes to invoice payment.

What does this mean for businesses? The billions of dollars caught up in delayed invoice payment in Australia pose an extra strain on them from both a financial and time-efficiency perspective, putting additional pressure on SMEs that they neither want or need.

Global payments technology company, Square, has crunched the numbers and released data on over 1500 Australian businesses to uncover who is behind slow payments. Among the details the it revealed are the fact that:

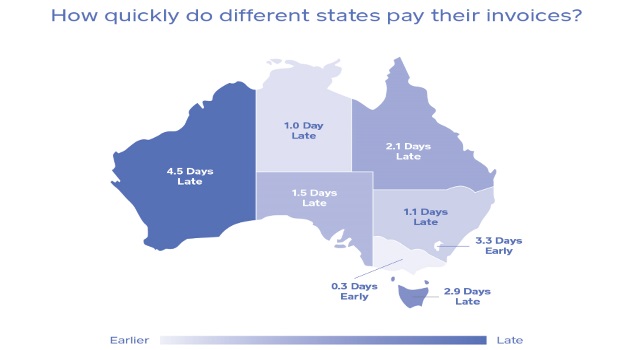

- ACT customers and business are the quickest state when it comes to paying their invoices –3.3 days early – whereas Western Australian businesses are the slowest, waiting on average 4.5 days over the due date.

- Bars, clubs and lounges are slowing the pace right down, on average paying 7.4 days late, followed by contractors, professional services and creatives.

- In contrast, accountants are the quickest to pay invoices, on average 7.6 days early.

- Businesses are better off using technology to get paid – when using Square Invoices, for example,payments were generally made 80% faster compared to traditional invoicing methods.

All the salient information to come out of the research is illustrated in this infographic: