How more sales can cause cashflow problems

The age-old question business clients ask their accountants is ‘How come I’ve made more profit but I don’t have any more cash’.

The answer to this question lies in the issue of the ‘cashflow cycle’. This cycle is an issue often overlooked by small-business owners until the business starts to grow and they begin to experience ‘cashflow squeeze’.

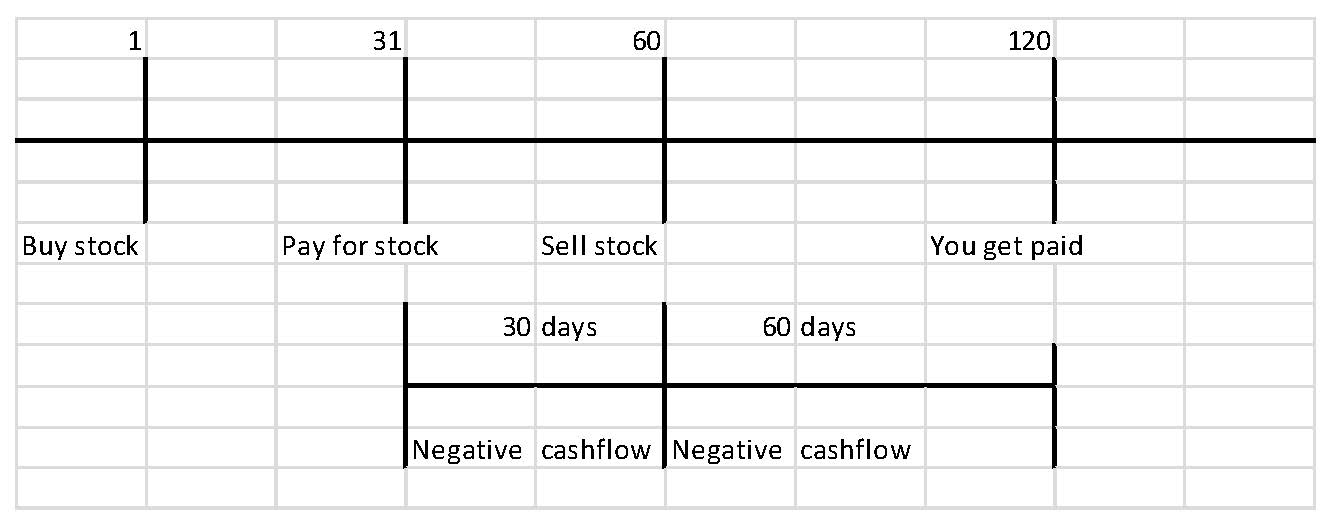

The diagram below helps to explain how it works.

Cashflow cycle

That’s 90 days of negative cashflow!

The diagram shows that:

- before you can sell anything you have to buy something – stock or labour

- depending on how long the stock sits in-store, you may hold onto stock for 60 days

- depending on the terms you get from suppliers you may have to pay for that stock after 30 days – this means you have 30 days’ negative cashflow, which is when your cash outflows for that period are higher than your cash inflows

- depending on your accounts receivable management you could wait 60 days to get paid – which adds another 60 days’ negative cashflow – this adds up to 90 days’ negative cashflow.

This means your money has been somewhere other than your bank account for 90 days, such as in your supplier’s or customer’s bank account. This is referred to as ‘funding the sale’ – also known as ‘working capital’ – meaning that you need to have a certain amount of money to fund sales all the time.

When growth causes problems

This causes a problem when growth occurs because the issue just gets bigger. If you aren’t working to minimise the number of days stock is in-store and the number of days customers are taking to pay, then the problem just gets worse when sales grow.

Sometimes businesses are too focused on increasing sales, and ‘accounts receivable’ gets ignored. This is why growth can often kill a good business.

Sometimes businesses are too focused on increasing sales and the issues of stock movement, and ‘accounts receivable’ gets ignored or is not considered worth investing in. This is why growth can often kill what appears to be a good business.

Work in progress or jobs in service-based businesses can cause cashflow squeeze if billing and payment terms are not well managed. It pays big time to calculate a billing and payment program with customers, taking into consideration the payment for materials and labour on a job. The ideal is to ask for a decent deposit upfront to cover as much of the material costs as possible, then progressive payments to cover labour.

A lot happens to cash on its journey from the sale to your bank account. If you are planning to grow your business, you must understand this phenomenon. Or else you could be heading for problems.

Sue Hirst, Co-founder & Director, CFO On-Call